I presented my journey 3 months in. Things have evolved and grown since then! I already realise we are going to be something different than a traditional VC. Read on to find out…

First things first we are now a real VC all be it a VC with a difference! We have investees lined up! We have an official launch planned & we have our FCA compliance in train shortly enabling us to take money from sophisticated investors.

To be clear, I know I am not an expert! I am simply journaling my experience. I have spent 15 years+ if not a lifetime in innovation and only 6 months in venture capital. I still have a lot to learn, I am a sponge. I am following the guide of experienced practitioners.

The future looks bright as we go on our journey from £10MN to £10BN but there are as ever many lessons ahead of us. Some of the top 10 lessons we are in the process of conquering and getting to grips with are listed below. Hope you enjoy!

Lesson 1: A jack of all trades is a master of none – Build a team of exceptional people!

I started off with the aim of learning everything well enough so that I had a grounding and understanding of the fundamental concepts of venture capital. This was time well spent it gave me a general idea of what a term sheet might look like, what the mechanics of the industry were. I soon learned that many buzz words and hot topic trends predominated and that as with every industry there is a hierarchy of understanding out there.

We made a number of faux pas during our formation to term sheets with unnecessary considerations in them. We had them drafted by lawyers and despite best intentions the first version was miles away from our culture and ethos.

Rather than work indefinitely by myself, previous experience taught me, it was essential from day one to have a team by my side and already I have got an exceptional one!

The Change Team, Our Team

Venture Partner

Dr Laura Bond is an experienced Venture Capitalist with some 15 years experience ranging from her early career at IP Group to working in M&A at Boots, to working more recently within other VCs. Laura has a PhD in Pharmaceuticals she is the Ying to my Jang challenging our start-ups towards success.

Finance Partner

So like any experienced CEO I can read and create a cashflow and balance sheet but there is something about an individual who has the capacity to go further. Colin Hutchinson brings his experience managing huge revenues at Digicel and Vodafone together with his own start up experience. He has worked with and for the best and brightest in business. People such as Denis O’Brien Irelands first billionaire and he has both the stripes and scars to prove it. I feel safe in Colin’s hands and so should our start ups.

People Partner

I study people and learn and grow from their input, Gavan takes that to a whole new level. Gavan Wall has taken an active role in my own growth and the growth of those around me, he knows who’s worth working on and when to give up. It’s one thing to say you accept your own frailties but it’s quite another to mean it and with Gavan by my side I realise more and more just how important picking and coaching the right people is to our future. Gavan has an eye for talent and for drive that backs up my own focus on delivery and strategy. We perhaps look an unlikely pair but share so many core values. Gavan intends to live to 150 so with that in mind I hope he won’t mind extending his 10 year promise of dedication to The Change, to a few decades so that we can change Northern Ireland for the better. We started this journey together and it’s already been a lot of fun.

Other Participants

I need to offer special mention to a few great people! Firstly, Greg Quinn for helping us build out our role descriptions. Without these I genuinely feel like we wouldn’t have focused on the right stuff no matter who the team was. Amer Bhatti our FCA guru who has overcome for us in a few days what had been taking months prior to Amer’s involvement. Lastly but not least, thank you Carol Rossborough and Ailis Mone. As potential investees, your due dil on us and other VCs helped us seriously up our game.

Lesson 2: Money may be imaginary/ virtual/ conceptual but it’s essential to understanding Venture

Money Vs Science Vs Logic

We won’t pretend to have a large fund. £10m is not going to change the world, if left to its own devices! We are smaller than most if not all of the public sector backed funds locally in Northern Ireland. We are new and on the face of it less connected!

However it’s our drive for growth and our belief in both investor and investee that will take us to another level. Our Investors have come from a diversity of business backgrounds, with others actually coming from general employment and the professions. There is a lot of work in managing this but with effort we believe that our backers can perhaps be one of our strongest assets. We gain from the experience and gut of our investors while ensuring we have the cajones to follow our own lead and bring the investors on a journey with us.

We already have a £100m fund in our sights but we know that every penny was hard earned and therefore do not take lightly our responsibility to ensure the success of each and every investment, and when and where inevitable failures do happen to pivot our efforts onto the businesses that will indeed succeed.

This is something we want to learn from the bigger funds about how they deal with failures! Despite many stating 90% of their effort is taken up by failures and sorting out messes very few pivot to ensure they don’t waste time on the doomed projects. At The Change we don’t want to dwell and draw out bad experiences rather we aim to learn from them quickly. Kindness is a virtue and when failure happens we aren’t there to spend time gutting founders, unless they have been fraudulent of course, rather we are here to rehabilitate that person back into normal life. After the visionary environment of The Change normal life may not be so easy to reacclimatise to!

Lesson 3: We are a value add fund. Venture Catalysts not just Venture Capital. Transformation is in our DNA and therefore the normal rules don’t apply!

We spoke with many other VCs and Angel Investors and were grateful for their time, but it was clear early on that what they did was very different to us. Their approach would attract very different investees and that they had a different expectation of those investees than we would with ours.

Additionally when we said we believed we could achieve higher returns for our investors we had the feedback that we couldn’t seriously expect to outperform the top 5% of VCs as a new fund. If we were just a money play, like most VCs focusing on identifying the right founders and hoping they would find their own path that would of course be correct.

We would be fools to expect that a team with poorer deal flow, less experience, less cash could outperform the big goliaths of VC land. But our approach is different, so the outcomes can be too, as we follow a value add approach, leveraging money with talent and expertise.

Founders come with flaws and unlike other VCs who perhaps perform better when a founder reverse vests and dilutes for their benefit. Or a founder by luck, as much as design, finds a pathway to success through trial and error, we supply support mentorship and a pathway to success.

For us it’s everyone else who seem crazy! We wouldn’t throw money after an unknown quantity, we want to know our founders before we proceed spending 3dyas with them prior to investment. Mutual trust, alignment and respect is essential to the success of our future relationship.

We are not perfect, neither are they but together just like the team at The Change itself we can be an unstoppable force. How many VCs will write a patent for you? How Many VCs will take the time to spend a day with you to pick you back up when you’re down? How many VCs will run a strategy sprint to stop you failing in the first place? To date I understand we are the only one…

Perhaps we aren’t a VC at all? Maybe we’re actually Venture Catalysts!

Lesson 4: The Three A’s – You can’t Pretend to know what you are talking about. You have to learn.

I have met Venturers with significant experience. Those who have the gift of experience can often rhyme off phrases which hold huge wisdom. For a newbie to VC like me those phrases can mean little until you reflect and better understand.

I have been described as a genius by a good many people in my lifetime BUT on many points I can be slow on the uptake. Anyone who tells me a joke knows I am the last person to get it!

I won’t ever pretend to know what I don’t know but I am clear I have entered a world where that is exactly what the majority do. One experienced advisor stated clearly in a short message that all that mattered in Venture Capital was the Three A’s. I’ve been a business person for 15 years and the three A’s were new to me. I knew the three A’s I might have considered were not what the individual was talking about. My due respect for him caused me to rack my brain.

So what did I do? I tried to read up on the three As. I tried google, I looked for books, academic papers but despite that I could not find conclusively what the 3 As were. I if honest was too embarrassed to ask. I had as an outcome found a diversity of opinion on what 3 things are most important to the success of a Venture Capital firm. I see our Venture Catalyst firm as an “Add Value” model in venture, more Venture Catalyst than capital, and consequently, my team believes we can push our startups up the success curve.

Perhaps those experienced in the field will tell me the real three A’s at some point but I state categorically I do not know them and I fully realise even if I did I am unlikely to yet be as intimate with the answers as those more experienced are.

Experience and drive for success are perhaps the two sides of the same coin. Experience brings to bare models of what has worked and has not. For me Dr Laura Bond fills that gap. Drive however identifies change and is part of how industries get disrupted over time. Through trying to force a square peg in a round hole it might just eventually fit!

There are a series of venturers whom I personally respect from my time on the startup journey. Kindred Capital among them, who added value to my business back when I was pitching my business to them. Dr Laura Bond did the same. All different angles but all adding value. I have since worked with PE firms who again add specific forms of value whether that be new structures or approaches to growth.

I see other funds regardless of how successful/unsuccessful their results, which cling to the notion that there is one set model as to how one can apply people to a problem to create money. That in my humble view is not the case. Most successful people know the importance of the right team at the right time delivering the right project. This is near impossible to predict or model as all three are moving targets and change!

By seeing a pitch for 5 minutes on Proton Therapy for instance some people will claim to understand the model or the play and pass comment. I am already much more reserved! I truly don’t see what validity a snap-shot opinion can hold. That said because it’s a fund and founders look up to funds then it’s clear that the snap-shot view can have a seriously detrimental impact!

If the investment isn’t for us and I know it I’ve quickly learned to say little unless it’s a space I know a lot on!

Lesson 5: Cash becomes an increasingly important factor in line with the success of a team and size of a company

A tremendously successful VC taught me a very true lesson. One that made me understand what we are doing differently, but also helped me to set expectation of performance.

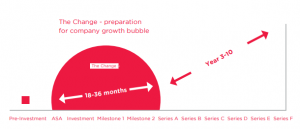

We are an early stage fund and hence as a result are relatively unaware of the next steps beyond the time our startups incubate and grow with us.

Venture Fund Management ie the next step after our bubble is generally like a punter backing a horse. The Venturer reviews the stats of a startup business, they identify track record and potential and then choose whether to invest or not invest. When the investment goes in, as per Robert Kawasaki of Rich Dad Poor Dad Fame suggests, the investor expects money to work for them.

Because the job is that of a punter the job essentially revolves around stats and concepts.

This approach excludes our own methodology, where we’re seeking to align with founders and be their catalyst, and as a result I believe we can’t be compared as like for like with different funds.

Even the big players with huge capital, often seen as signallers of success have a maximum return from making money deployed work for them. They’re often investing large amounts when scale has already been achieved.

Earlier stage startups and scaleups invariably have problems of management and operations, meaning that expertise can be more valuable than money. Protecting someone from exploring the wrong areas and making the wrong mistakes can often be invaluable.

Our founders like all of us have only one life, and may have only one shot and we want to protect them and that finite resource from unnecessary harm.

We have less money than bigger venture funds, so the assumption may be that their financial clout or investment acumen is more valuable. But our solution is that it’s not just about money, we an amazing yet small team of great experienced people who add value to the firms that we work with in a unique and specific way.

Think of us as the trainer or horse whisperer rather than the punter. We really can influence the performance of the horse.

If the question is can we outperform money and financial markets through applying people? Then my answer is absolutely yes.

If I didn’t believe in the great people I have around me then we wouldn’t have started in the first place.

Lesson 6: It’s not all about startups! Scaleups and long term ventures matter too!

There can be an artificial focus on startups in most early stage VCs. Businesses can take a long time to mature particularly in certain industries. A business going 15+ years can in fact be argued to only be getting going.

Core to the future of The Change is its ability not only to start businesses but its ability to see them through to success in a world that has a requirement for real tangible change.

The truth is a startup is a business founded by someone who has a lifetime of experience sometimes outside of the business domain. A more traditional founder has gone through the various hard knocks of business and has survived to tell the tale. What they can lack in future vision because of this journey they can more than make up for in street smart and savvy.

We are always on the lookout for existing businesses that could be the jump off point for global change. Change that comes from a new take on an existing business from within an existing team, and that which grows within a new business needs a different approach to adding value.

The long and short of it is that there is value in the business already. When minds align even more can be created through working with The Change. The plan would be that we can take an investee from this point on their journey to a brand new exciting future even if the business has been more pedestrian to date.

The reasons for large breakthroughs not happening are manifold, from lack of experience, to lack of succession planning, the owner holding too tight and not building a Team, to an overall lack of vision on what comes next. But just because a business doesn’t yet have the drive to proceed to the next level, doesn’t mean it can’t happen with the right catalyst.

For us success in a traditional business even at the £1ms or £10ms of level can be the launch pad to genuine multi billion business. If you have a drive to take a business to the next level of success but don’t know how to scratch that itch get in contact!

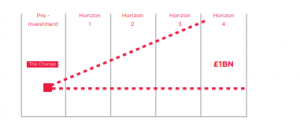

Lesson 7: For a £1Billion mindset its about value not revenue! (Even if both would be nice sometimes!)

Data and other KPIs can be set during horizon 1. Revenue is the measure of eventual success but as a seed fund we need to first show value at its core.

We invest in many businesses that are pre revenue. We do this because we believe in people. Human capital is what our investment is all about. As such if a founder is intelligent enough to realise that they can’t survive the 2 years it takes to create their product on baked beans and toast but they are willing to do the legwork to plan a model then why would we penalise them because they haven’t hit £10k a month in revenue? Our experience of how our founders were approached by other VCs is often different probably because of the different fit.

It’s “SHOW ME THE VALUE” for us, where it might be show me the money for others!

I’m sure many people will say I am wrong and I have yet to be proven right but my current philosophy is that we can add transformative support to make amazing businesses that are greater than the sum of their parts.

Per example we are considering buying out a data driven business with 200 million accounts (1/10th of Facebook) , so that it can be transformed via a series of value add steps into a revenue generating behemoth. It’s highly unlikely any founder will have all the skills needed to pull off this deal. Roll up Dr Laura Bond and Colin Hutchinson for the acquisition process and we have a strong chance of success!

Lesson 8: Not all funds are created equal. Not all funds look for the same thing! In fact most funds are looking for different things in companies! Don’t change your business unless it makes commercial sense.

I have now met a large number of startups and trading businesses that essentially want to be invested in. The desire has often overtaken rational business sense to the point that they believe they need investment as a mark of success.

That way of thinking is clearly not correct! Equally the bravado of a pitch can often extend to overconfidence. Ambition is attractive, however unrealistic and crazy assumptions can take down what would have otherwise been an amazing pitch.

I would coach investees to be open. Be Humble! Be clear what you have achieved or have not and be clear as to your challenges with equal measure as to how you might overcome those same said risks.

A believable pitch as with all things will come from the development of trust and that takes just as much openness about your issues and failures as it does about your successes.

Lesson 9: Leadership Vs Management – Not Getting too involved!

I have spoken to some of our startups and with our particular model, because it is so different to the other players, they can be concerned that we will get too involved. They have been used to stand off Venture Capitalists who will stay at arms length, police their money and watch as they fail.

Our model is much different than this and involves particular interventions. We are here to help our founders through the most difficult experience of their lives.

You might be able to run a marathon and think you’re fit, but creating a £billion startup is like running x10 of these back to back. Launching a startup has been described by some as the equivalent of giving birth (as a man I couldn’t comment) but doing this to success might be more like birthing triplets!

The Change is not prepared to stand back and watch your business fail. Rather it expects to support you in creating the success you are going to become.

We don’t stand by and watch as you make mistakes instead we step in with guidance and support when and where we can add that value.

When you are trying to create a “Blue Ocean,” uncontested market space the last thing you need are the basics of business holding you back.

We are here to supply leadership to your executive so that they can overcome the hurdles and also supply coaching to your executive so that the operational thinkers can correctly manage the entrepreneurs within the team.

Each business is unique and its leadership culture will often reflect this. We’re there to facilitate your culture!

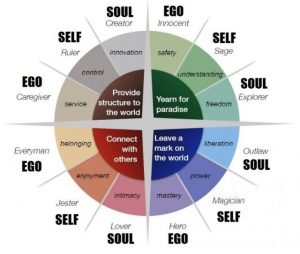

Mapping Leadership Culture Harvard Business Review

Illustration courtesy of HBR

We want to be clear that we aren’t going to manage your business for you! We will of course help you find the right people for your journey but The Change is a Venture Capital firm and here to build the people we work with into effective leaders. Whatever their style!

Psychometric Profiles by Harvard Business Review

Illustration Courtesy of HBR

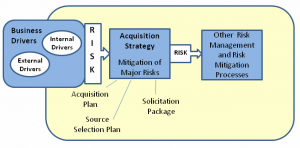

Lesson 10: We are an early stage / seed fund at this stage. We need to get in first!

The truth is once a company, trading or otherwise, takes on its first venture capital it changes. Although that change is often unpredictable it’s clear that it’s very real.

We know from experience that founders often take the wrong money. All money is not the same. If this happens founders can get beat up and rinsed, and taught the wrong thing by fund managers.

The truth is from our perspective that if we are to transform someone and their startup it’s easier to do it from a first in position.

Serial founders and first time founders alike are heavily influenced by fund managers therefore we need to get involved before someone else does.

£1m spent on one strategy can in fact decimate the chances of success of a business if it should have taken a different journey. It also spoils the spot and the future of the founder and business alike.

Lesson 11: Always present your best! Branding Matters even for Venture Firms

As a venture fund we didn’t just start because of angst over a previous career going badly, or an opportunity to make a quick buck.

We started because we wanted to support values in a country and industry where our values are often overlooked or undervalued.

This focus on values has enabled us to build a brand message that will change the lives initially of 8-10 entrepreneurs in our first fund. But then this will ripple out to services, £ value, enterprise and additional employment in the wider economy as successes follow.

Even with our branding and consistent message we nearly lost a some investees as we developed our offering which in the embryonic stage can take a while to have the right clarity when you’re doing things differently to the market.

We’ll continue to work at it because brand and presence matters!

Lesson 12: Why grow when you can acquire

I have been fascinated learning from @Terry Brannigan how acquisitions can really transform a business from No revenue 🡪 £millions 🡪 £billions

A controversial one to consider for startups. Very few companies look to an early stage acquisition strategy and yet having heard a few pitches that included such strategies I am extremely intrigued as to why more founders are not encouraged down this route.

Acquisitions have their challenges but changing the direction of existing businesses can often be the best way to achieve strong results quickly. A new leadership or an augmented leadership can take solid process found in existing businesses to the next level.

It’s up to the founder how they grow and acquisition requires different skills and processes than organic growth. That said explosive growth in turnover and profit, together with instant access to capital via effective purchase of trading businesses is one of the fastest roads to success.

Watch this space in regards to the trajectory of some of our own incubated investees. They will certainly have multiple options to consider in regards to their own growth trajectories!

Lesson 13: Clustering of investments, Investees & Investors!

Good things come in pairs the best come in many multiples of that. Clustering of investments adds both opportunity and scale to a concept. As a venture fund investing in clusters of companies will expand the Venture Firm’s understanding of a market and the investees ability to leverage their time with other investments.

It’s important not to have a random investment strategy, a firm needs to know what it’s talking about and needs to be able to add real rather than conceptual value!

Clustering and going sector specific to your knowledge will facilitate this. At The Change we’re interested in Tech and Science.

Lesson 14: If you want to think big, think different populate your team and suppliers with people who think the same way.

It’s been a long learned lesson that when working in Northern Ireland one can easily fall into a parochial mentality. Avoid this by surrounding yourself with bigger thinkers to help you to think similarly.

There are great services here with some of the local law and accountancy firms but don’t limit yourself to them and be open to those in London and further afield who can bring a wider perspective!

Using the wrong people will limit your aspirations and will no doubt ensure your own thinking is limited to the extent of theirs.

I’ve made mistakes along my journey in the past of using the wrong firms and getting advice from people as new to tackling a novel problem as I was. That approach can be a recipe for disaster. So you have to get the right team of advisors.

The best use of your time is to find the right team to surround yourself with, and using the right person for the right job!

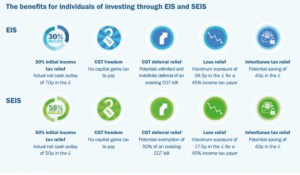

Lesson 15: Tax Status must be considered

It’s a bald truth to state that money is more accessible to the wealthy than it is to the poor. In a way it was ever thus. Some might argue that rebates in the tax system to protect investors from downside risks of high risk investments entrench this. But with the average rate of return on investment being -12% in early stage startups it’s important that we appreciate that the risks in early stage investments and encourage investors to provide the backing, as people with ideas that need financial support is agnostic to class.

So tax rebates can really move the risk reward ratio dependent on the deal. My FCA experience to date has been an eye opening one with SEIS and EIS tax rebates significantly derisking the downside of an investment. 30%-50% instant return on the money and a further tax reduction should the company close. The upside is in fact tax free under the SEIS/EIS scheme and outside of institutional investment that upside should not be ignored.

It is an amazing benefit and can only help to increase opportunity across society as money follows good ideas and people when it’s encouraged like this.

Lesson 16: Co-operation is key

We have a myriad of partners and working well together is critical to our combined success.

Starting with a team. You don’t need hangers on you need individuals who add real and specific value to your firm. Select the best and brightest. Those who you know will do a better job than yourself in their respective fields. People who share values and whom you trust.

Following on your support teams in legal, financial, FCA must be particularly special people. They must be of an extremely high calibre but also value your work just as much as you do. Finding @Amer Bhatti was an extremely fortunate for us as we navigated the minefield of FCA compliance.

Forming partnerships is important. Even when you don’t get to work together often having a network of people who can help and advise you, finding the right partners is critical. It’s important to work ethically and with positive intent so that those you work with respect you and your input.

Whether it be through working with select local Organisations and Individuals such as @Chris McClelland @Ian Brown at Ignite @Steve Orr @John Knapton at Catalyst the team at Barclays @Lisa Baille or Danske @David Allister or Claire Dowds at the Ormeau baths.

Or working with our partners further afield co-operation in terms of identifying, funding, supporting, marketing and integrating start ups is key to our organisation’s success.

Every relationship is tested at times, those relationships that matter deepen and grow through the tests and those that don’t deepen and grow should fade away as quickly as possible. In the life of a start up we must invariably be careful to ensure our founders grow and succeed.

Next Steps

I will struggle to list everything I want to in this short article. So many things have been happening recently!

I have just completed the FCA process which was an interesting and beneficial experience to add to my bow and also became a dad for the fourth time during the course of this journey! My daughters even chipped in along the way! It’s been an amazing 6 months. What a year of transformation 2019 was and I look forward to a year of success in 2020, the foundations of which have been laid!

Our next steps are becoming clearer. Albeit I imagine we’ll have a few twists and turns along the way. From taking institutional money, acquiring and accessing talent within a venture context to backing and facilitating startups and planning exits. It’s all ahead of us! As long as this journal is useful to people I will keep it up!

Our spaces are filling up really quickly, for our first fund, we are looking for 8-10 inspirational founders. We already have some amazing startups on board and we will be promoting those over the coming months.

The Change will only be as good as the people we invest. Based on what I’ve seen so far that means we’re going to be pretty darn good. Our investments as you will come to see are The real Change we want to see in the world!

Recent Comments